Patent Mapping in Thermal Spray Technologies

- July 2, 2025

Patent mapping offers valuable insights into innovation trends, geographic advantages, and strategic opportunities by showing the evolution of technology. In order to investigate the current state of advanced surface coating technologies, such as Cold Gas Spray (CGS), High Velocity Oxygen Fuel (HVOF), and the larger field of Thermal Spray technologies, patent analysis has become an essential tool in CoBRAIN.

Patent mapping is essential for locating unexplored areas of invention and commercialisation potential, in addition to being important for comprehending what has already been accomplished. Stakeholders can better understand where technical activity is concentrated, where new markets can develop, and how CoBRAIN’s findings fit into the global innovation landscape by analysing patent trends across time and regional distribution.

To unlock these insights, this blog article presents part of the extended patent mapping analysis for CoBRAIN technologies, carried out by our partner EXELISIS. The analysis focuses on two key dimensions: the evolution of technological activity over time and its geographical concentration. By examining annual filing trends and the distribution of patents across global authorities, we can identify not only the pace and direction of innovation, but also the regional priorities and market dynamics that influence it. The following sections explore these aspects in more detail, starting with an overview of how patent activity in CGS, HVOF, and thermal spray technologies have evolved over the past two decades.

Patent Trends Over Time

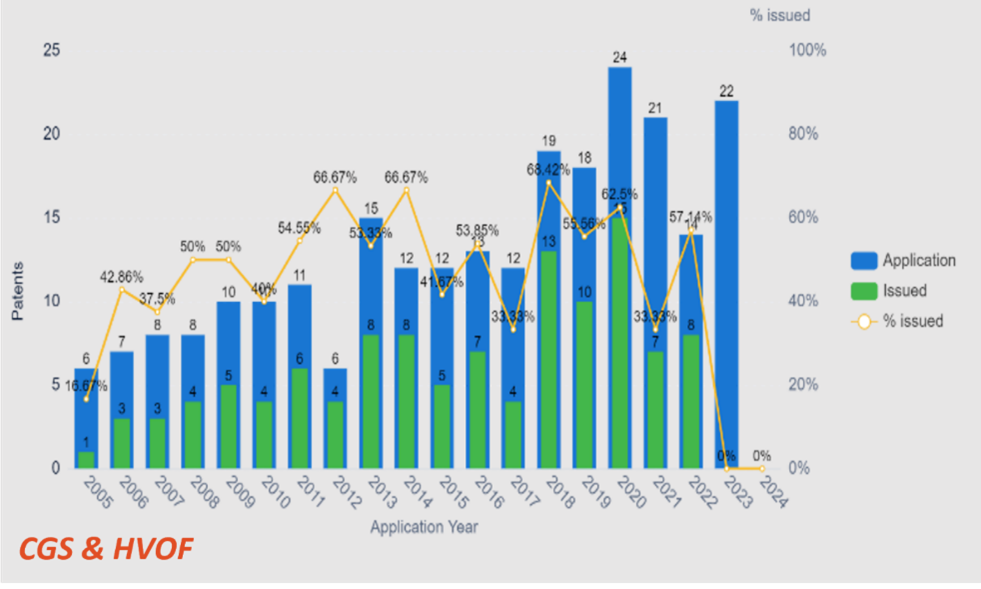

Understanding how technology develops over time is one of the main goals of patent mapping. From 2005 to 2024, the patterns in patent filings for CGS and HVOF technologies demonstrate a consistent rise in interest and advancement. After 2016, the number of applications increased steadily, reaching a notable high of 24 in 2020. The comparatively constant percentage of awarded patents, which is frequently higher than 50%, indicates a high conversion rate from application to granted status. This high issuing rate indicates that applicants have a solid grasp of the IP environment, are technologically mature, and have high-quality patents.

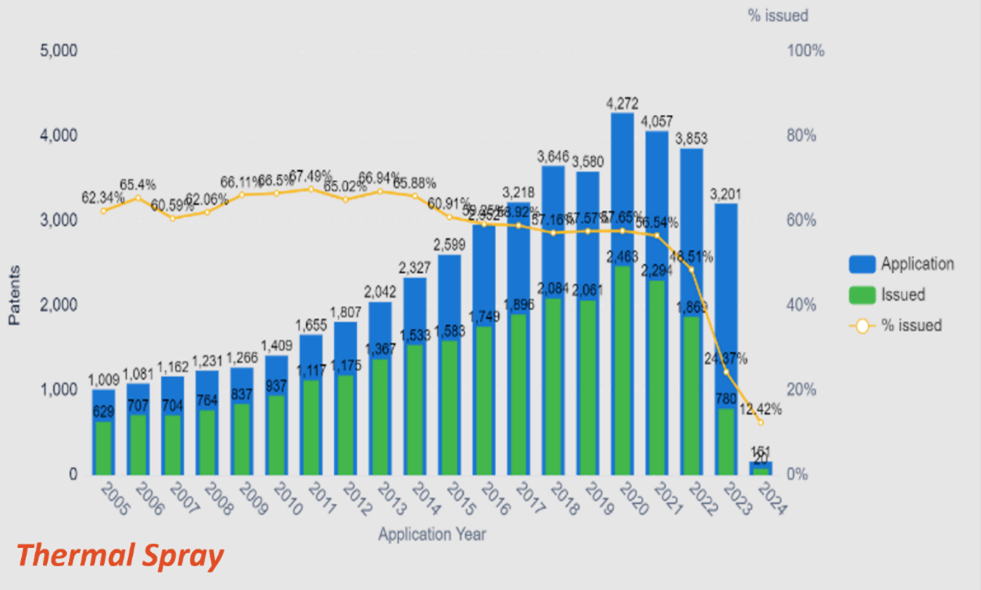

The volume of activity in the thermal spray field in general, is substantially higher in comparison. From just over 1,000 in 2005 to a peak of over 4,200 in 2019, the number of patent applications increased. The percentage of granted patents has recently decreased, which could be because of delays due to COVID19, rising competition, changing patent office inspection, or the complexity of current applications, even if the number of issued patents closely followed over most of the period. Nevertheless, the general rising trend shows that thermal spray technologies are becoming more and more popular across a range of sectors.

These timelines provide key indications for R&D strategy in addition to providing a historical view. Increases in patent applications may be correlated with significant advancements in complementary technologies, new environmental rules, or important industrial advances. For example, when companies move away from risky procedures like harsh chromium plating, the increase in CGS & HVOF filings after 2016 might be related to the drive toward more environmentally friendly, effective coating techniques.

Geographic Distribution of Patents

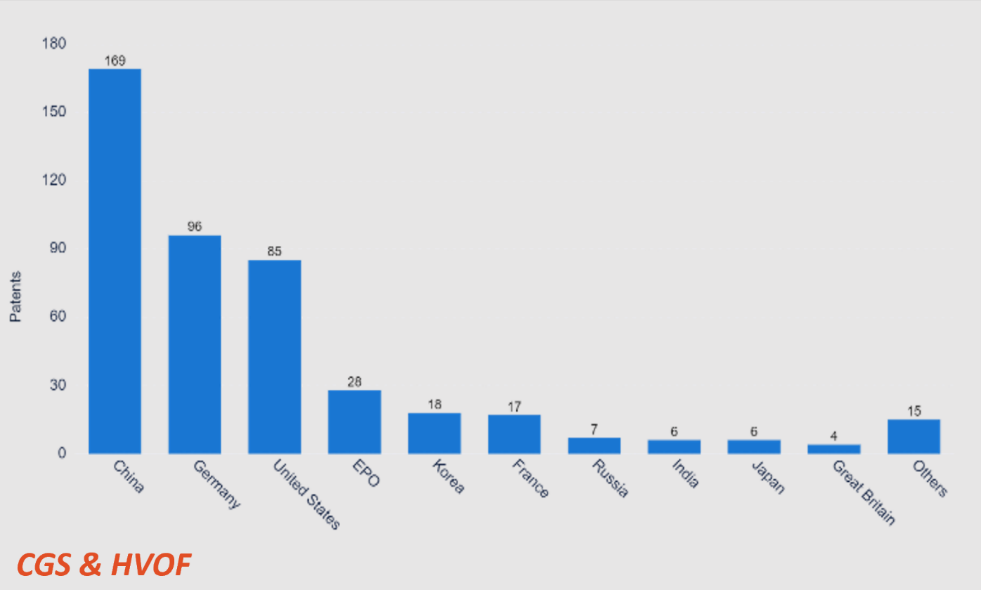

It is important to understand the regional distribution of patent activity in addition to trends over time. With 169 patents submitted, China is the top jurisdiction in terms of CGS and HVOF patent distribution, followed by Germany and the US. While Germany and the U.S. exhibit robust industrial bases and academic-industry collaboration, China’s authority reflects a national emphasis on coatings innovation and domestic IP protection.

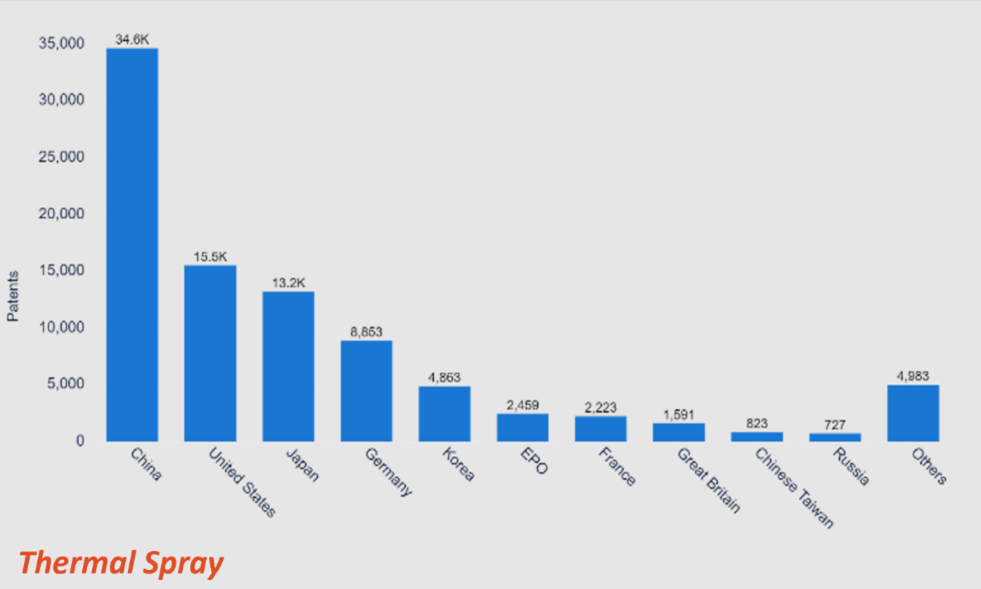

However, the patenting activity in the thermal spray industry is considerably more extensive. With more than 34,000 filings, China is once again in the lead, followed by the US and Japan. Significant presences are also maintained by European nations like Germany and France, as well as organisations that file through the European Patent Office (EPO). These numbers demonstrate how competitive and popular surface engineering and materials science are around the world.

This type of mapping highlights important factors for CoBRAIN and its partners’ future patent strategy. China and Germany are two examples of regions that could represent both strategic markets and competitive settings. On the other hand, less saturated areas may provide white space for new applications, collaborative projects, or regional collaborations.

Furthermore, a region’s patent density may be an indicator of its level of industrial maturity. High application counts are frequently associated with areas with strong public-private research ecosystems, manufacturing hubs, or innovation hubs. By understanding these interactions CoBRAIN manages to better align with funding opportunities, commercialisation pipelines and legislative objectives.

Strategic Implications for CoBRAIN

EXELISIS provides more than just a historical overview through patent mapping – it offers valuable insights that partners can use strategically. By analysing the locations, filing patterns, and trends of patents, CoBRAIN partners can develop more effective innovation and distribution strategies.

For instance, the high volume of patent applications in CGS and HVOF technologies suggests that these areas remain open to further innovation, particularly in specialised sectors such as aerospace components or environmentally friendly alternatives to conventional methods. Gaining a clear understanding of where CoBRAIN solutions stand – alongside those of competitors – can be highly beneficial. This includes identifying key players that frequently appear among top filers, such as major industrial companies or research institutions.

These insights can support not only potential collaborations, licensing, or technology transfer opportunities, but also guide outreach and communication strategies to maximise the project’s impact.

Building an Innovation Roadmap

Combining this external data with internal project goals is a more extensive patent mapping technique. This includes identifying important white spaces for CoBRAIN, which are regions with little patent activity but significant project output importance. These white areas might have to do with new material combinations, coating monitoring powered by AI, or incorporating sustainability standards into performance evaluations.

Additionally, patent mapping helps the consortium manage information more effectively. It contributes to the accumulation of knowledge regarding the position of CoBRAIN technologies in the larger innovation ecosystem. Resource allocation, exploitation activity prioritisation, and even partner-specific guidance for upcoming patent filings are all supported by this data.

Risk management also benefits from patent mapping. It is possible to avoid costly intellectual property conflicts, minimise freedom-to-operate issues, and save duplication of effort by having a thorough understanding of the crowded or highly competitive regions of the field. This is especially important in highly regulated industries like energy, healthcare, and aerospace, where coatings have to adhere to stringent performance and certification requirements.

Final Thoughts

The CoBRAIN project utilises patent mapping as a strategic compass, enabling the consortium to make informed, forward-looking decisions on commercialisation, innovation, and intellectual property protection. With support from EXELISIS, which leads the patent analysis, CoBRAIN partners can better position their results for market uptake and societal impact by examining regional coverage, technological saturation, and trends over time.

Understanding the patent landscape is essential, as global demand for high-performance, sustainable coatings continues to grow. The insights derived from thermal spray, HVOF, and CGS technologies reveal not only the dynamism of these fields but also the untapped potential that CoBRAIN is poised to address. Through comprehensive mapping and data-driven foresight, CoBRAIN – together with EXELISIS – contributes to Europe’s transition towards safer, more sustainable, and more advanced industrial processes.